stash invest tax documents

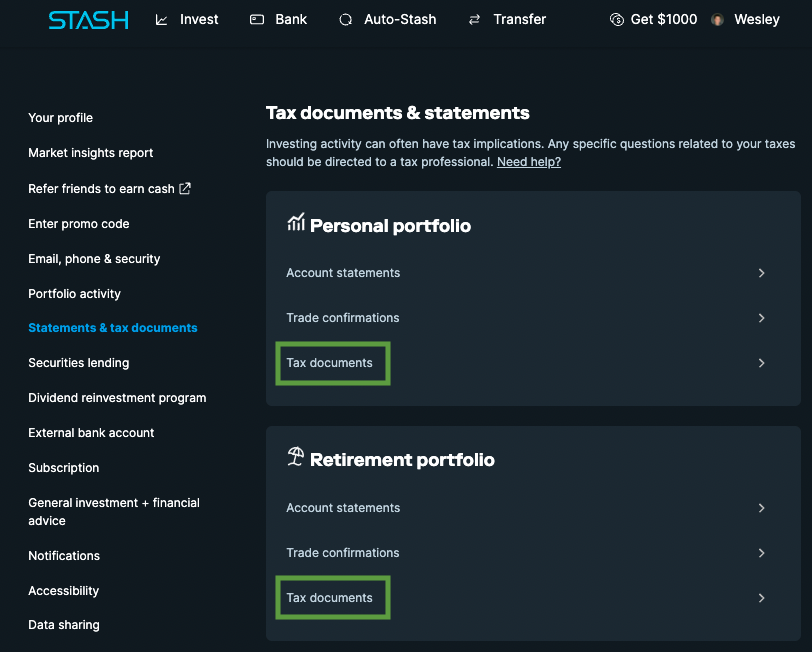

You received dividend payments greater than 10 from your Stash Invest investments in 2021. Click Tax Documents for each Stash account.

Stash App Taxes Explained How To File Your Stash Taxes Youtube

You received dividend payments greater than 10 from your Stash Invest accounts in 2021.

. Products offered by Stash Investments LLC and Stash Capital LLC are Not FDIC Insured Not Bank Guaranteed and May Lose Value. Market data by Thomson Reuters Refinitiv. Stash Tax Forms Available.

Qapital is a banking app that makes saving and investing money fun. Each year Stash will send you tax documents so that you can file your taxes appropriately. Tax Advisory Services with Dedicated Tax Consultants and a Flexible Suite of Services.

You sold an investment in your Stash Invest account in 2021. Ad Build an Effective Tax and Finance Function with a Range of Transformative Services. The easiest way to do this is through the Stash app under SettingsStatements and DocumentsTax Documents.

Will I Have Tax Documents from Stash. You have a retirement account with Stash and havent made any withdrawals. It includes a personal investment account the Stock-Back Card 1 saving tools personalized advice and 1000 of life insurance coverage through Avibra.

Stash Invest accounts are taxable brokerage accounts. From Simple to Advanced Income Taxes. You likely wont have tax documents if.

So just a heads-up for those of you waiting on this to file your taxes. Stash Invest accounts are taxable brokerage accounts. In TurboTax select the financial section that corresponds to your 1099 type.

Have 2021 tax documents shown up in anyones account yet. 0 Federal 0 State 0 To File offer is available for simple tax returns only with TurboTax Free Edition. It can work for first-time budgeters and investors.

Is a digital financial services company offering financial products for US. Another thing to take into consideration is the increased Child Tax Credit which began in July 2021. Copy or screenshot your account number and type of tax document is.

Stash will email you when your tax forms become available. You sold an investment in your Stash Invest account in. It can work for people who want to expand their long-term wealth building plan.

Ad 0 Commissions Online Specialized Trade Platforms Satisfaction Guarantee. Stash will email you when your tax forms become available. You made a withdrawal from your Stash Retire IRA of 10 or more.

You should have tax documents from Stash if. You should have tax documents from Stash if. You are required by the IRS to report income earned from capital gains and other applicable distributions.

The Password will be your SS. Its under Statements and Tax Documents once you click on your name at least on Desktop. Under Apex Username type 10- and the Stash account number located at the top of your 1099 proved by Stash.

If you have not received a 1099 form from Stash you should check your online Stash account to see if a 1099 form has been provided for you. Stash aims to make investing approachable for beginners. Instead you can manually type in a summary.

Stash is not one of our import partners. If you have tax documents available well send you an email. 1099-DIV 1099-B etc at the top of pg.

The Supreme Court in Kaestner addressed whether North Carolina could constitutionally impose income tax on a trust based solely on the resident status of the trusts. For my tax document a lot of Date Acquired box 1b information are missing. Stash Growth costs 3month.

You made a withdrawal from your Stash Retire IRA of 10 or more or. If unsuccessful youve likely selected the incorrect entry screen. In TurboTax select the financial section that corresponds to your 1099 type.

And heres a bonusTurboTax offers Stashers up to 20 off federal tax prep. You can access historical documents year round Tax Documents section of Account Management. The 1099-B is a tax form sent to you from Stash so that you can report any gains or losses from selling stocks mutual funds or EFTs during the year.

If you do have a 1099 B form here are the steps to follow to enter any investment gainslosses on sales. 245 8 th Avenue. You received more than 10 in interest on your Stash Invest account.

Ad IRS-Approved E-File Provider. If you will receive Stash tax forms they should be available on or before February 16 2021 in the Stash app or on the web find them here. You can enter 4 lines and cover the entire form.

Click the Tax Forms link on the page or from the Account Services Settings menu. Once you submit your electronic copy TurboTax prints out a cover letter and. However as portfolio company investments have shifted from the corporate form to flowthrough and disregarded entities such as partnerships and limited liability companies LLCs the PEG space has become inundated with state income tax issues and traps for the unwary triggered by complex state-to-state variations in the treatment of tiered.

You likely wont have tax documents if. You received more than 10 in interest on your Stash Invest account. When you enter summary data only you are required to send a copy of your 1099B to the IRS.

Click Tax Documents - now youve got the documentation you need to declare any income or loss you may have. I just checked my account and tax documents are finally available for 2019. Over 50 Milllion Tax Returns Filed.

You are required by the IRS to report income earned from capital gains and other applicable distributions. Come talk about Stash investing and personal finance. You made a withdrawal from your Stash Retire IRA of 10 or more or You sold an investment in your Stash Invest account in 2021.

As part of the 19 trillion stimulus package known as the American Rescue Plan the IRS increased the child tax credit for children under the age of six to 3600 and for children between six and 17 to 3000 from its current 2000 per child. This form is sent to you by Stash if you earned more than 10 in dividends from EFTS or mutual funds OR if you earned any divided directly from a stock. Stash will make your relevant tax documents available online in mid February.

Nonresident trusts are only taxable on undistributed income that is sourced to the state. If you have tax documents available. Resident trusts are subject to tax on their undistributed income.

We also make videos geared towards investors looking to learn the basics of investing which includes how-to videos of investing apps like Robinhood Webull Schwab TD. This was my first year trading etrade and robinhood both say Feb 15th. Copy or screenshot your account number and type of tax.

Each year Stash will send you tax documents so that you can file your taxes appropriately. Quickly Prepare and File Your 2021 Tax Return. Advisory products and services are offered through Stash Investments LLC an SEC registered investment adviser.

Type Apex and select Apex Clearing. Get started with. You will not be able to import your files.

Now you can automatically upload your Stash tax documents with TurboTax. Stash is not a bank or depository institution licensed in any jurisdiction. The service has no account minimum though managed Smart Portfolios require 5 to get started and charges 1.

It says they may not be posted until February. If you do not have a 1099 form from Stash then you do not have anything to report on your tax return. Up to 20 off TurboTax.

Take a few minutes to read our community guidelines. Firm Details for STASH INVEST Location. You can access historical documents year round Tax Documents section of Account Management.

You received less than 10 of interest andor did not sell any investments before the end of 2020. Stash will make your relevant tax.

Online Tax Resource Center Stash

Stash 1099 Tax Documents Youtube

Online Tax Resource Center Stash

Stash On Twitter Tax Season Is Complicated Make It Easier On Yourself Save This Post To Help You Keep Track Of All The Key Dates Click Here To Read More Https T Co 0tnqkbmkx7 Taxseason

How Investments Are Taxed Stash Learn

Online Tax Resource Center Stash

Turbotax Direct Import Instructions Official Stash Support

Stash App Taxes Explained How To File Your Stash Taxes Youtube

Turbotax Direct Import Instructions Official Stash Support

How To Get Your Stash Tax Documents Youtube

Hackers Begin Spoofing Fintech Apps As Tax Season Approaches

How To Get Your Stash Investing Account Statements Youtube

Online Tax Resource Center Stash

If I Don T Recieve A 1099 B From The Stash App Do I Still Report Anything On My Taxes Stash Website Says That If You Opened Your Account In The Last Year They

How To Cancel Stash 100 Working Your Cancel Guide

If I Don T Recieve A 1099 B From The Stash App Do I Still Report Anything On My Taxes Stash Website Says That If You Opened Your Account In The Last Year They